Dollar Cost Averaging vs Lump Sum Investing: The Result May Surprise You

Last updated: Sep 23, 2022

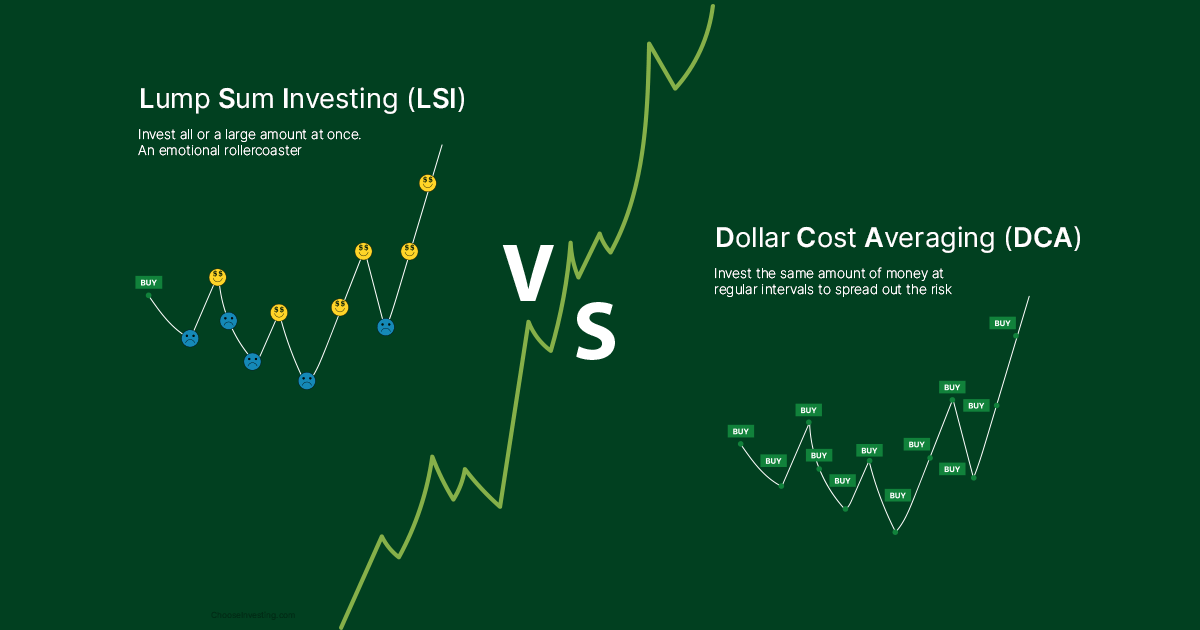

There is a clear winner from a mathematical and average standpoint backed up by studies. But still not suitable for every case. And not for just anybody.

We can never know what will perform best for every case. But Lump Sum Investing is best on average but requires a higher risk tolerance.

Most retail investors lack risk tolerance when it matters the most.

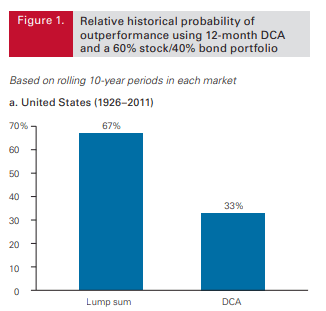

Studies on DCA vs LSI

Dollar-cost Averaging Just Means Taking Risk Later

This study from Vanguard 2012 tested taking $1,000,000 and either LSI or DCA over one year.

Those charts are 60% equity (stocks). And 40% bonds, however, barely any difference between taking only equity or bonds.

So LSI wins ⅔ of the time.

The next question is how much does LSI outperform DCA? On average, of course.

US: 2.3%

UK: 2.2%

Australia: 1.3%

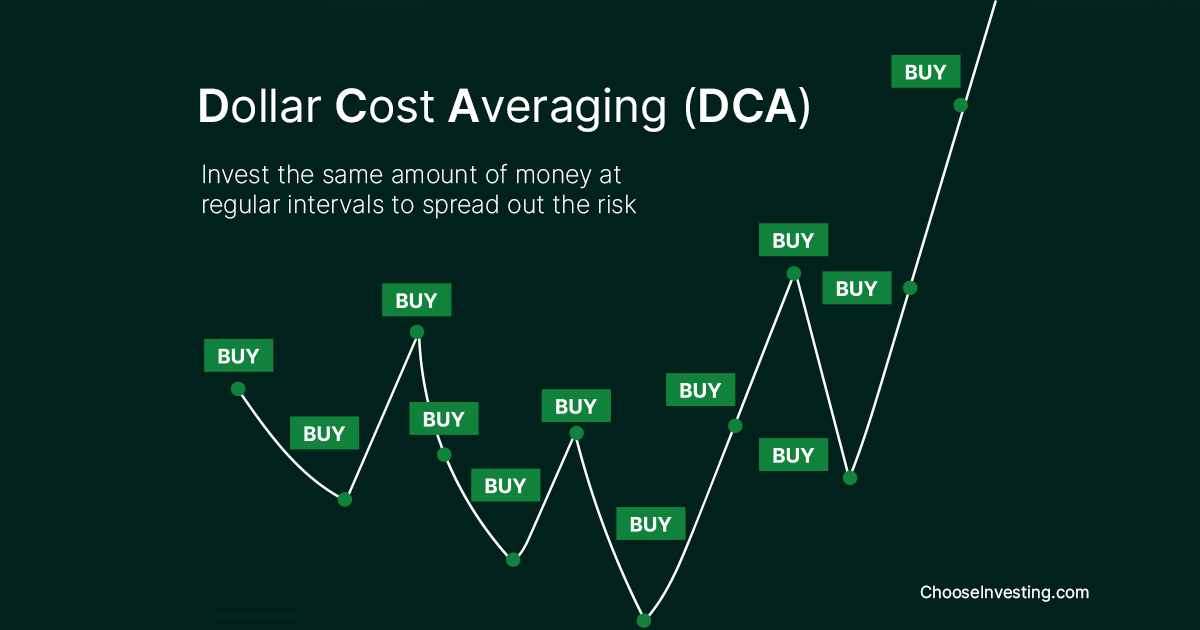

Dollar Cost Averaging (DCA)

Dollar-cost averaging is safer and makes more sense on a psychological and mental level.

Investing is emotional, and people tend to perform less good because of that. So DCA can be great for beginners and people who know themselves acting too much on emotions.

- DCA is mentally better. It is easier to stick to the investment and continue to contribute.

- Performing very well in down markets. If the market/stock is dropping you will have paid less.

- More fees, in most cases. Since the bank charges per transaction.

- On average worse than LSI.

- In a bull market, LSI is winning.

Remember, you are always human first. No human nor animal is without emotions.

Since if the market drops, you are happier you made this approach. DCA is performing better than LSI in downturn markets.

And handling downturns can feel safer when you know you don't have all invested.

The problem is that on average stocks tend to go up 78% of the time. Why I would guess LSI performs better over the long run.

Remember to use a DCA Calculator

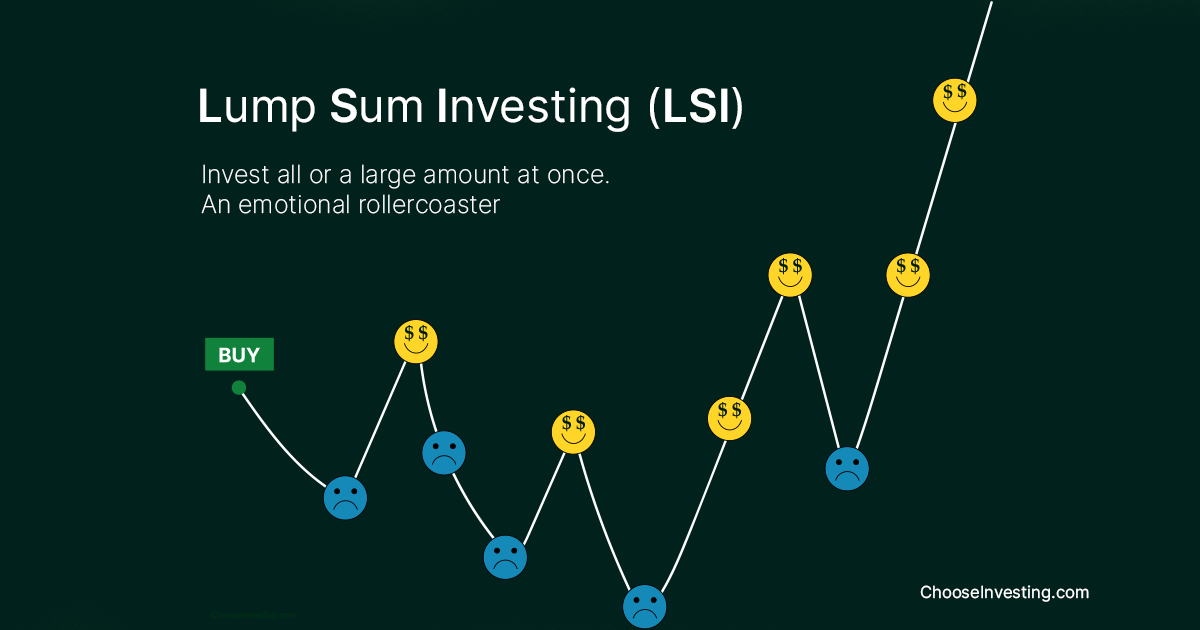

Lump Sum Investing (LSI)

Time in the market is more important than timing the market. And this is why this strategy can perform so well.

The risk is greater doing this. Buying a lump sum and experiencing a decline is a reality. The volatility is huger and that is why it can perform so well.

- Fewer Fees. Since you pay the bank per transaction and you only did one.

- Greater Volatility. Provides more opportunities for gains

- Rising Market. In a bull or increasing market, LSI tends to perform better.

- The more time in the market, the better.

- Greater Volatility. This means you can lose a great deal.

- You stuck with that investment. You cant change your mind without selling all.

- The drops feel larger. That 40% drop hurts a lot more.

- LSI requires a high-risk tolerance.

But that is also why it can perform worse. I have lump sum bought stocks. And they went down over 50% in a few months.

You must have the stomach for this approach and know you can deal with drops of this size.

This approach wins, on average more than DCA, but that doesn't mean it will always win. Or is best for your investment style.

Financial Risk Tolerance (FRT)

How much risk can you take? It's easy to say you have a high-risk tolerance until the storm breaks out.

When stocks only go up. The majority of people sure have a high FRT.

This is why it can be a good idea to try to understand how other people's FRT has been. By looking at the markets it's easy to see that people have less risk in down markets but a higher one in low ones.

Conclusion

On average, with LSI you are outperforming ⅔ of the time. By around 2%.

The DCA is safer and mentally better. You won't be putting all your eggs into the investment or market now.

With DCA you can also change your mind and start to lump sum if a favorable decline occurs.

LSI has a high risk associated with sudden price declines. If the market drops shortly after, you cant take advantage of it again.

In short, if you have a low financial risk tolerance, DCA may be best for you and still outperforms ⅓ of the time.