10 Signs You're Wasting Your Time in The Stock Market

Last updated: Nov 12, 2022

How often have you questioned if you wasted your time in the market? Here we will see a few typical signs of wasting time in the market and how to avoid them.

When I started investing in stocks, I avoided many errors I later saw in others. I read about investing before and while stock picking.

And it dawns on me that people are not even applying the bare essentials. And by no means am I a professional. Also, I have done and continue doing my fair share of errors.

I apply basic investment principles. The beauty of investing is that it is simple at its core.

1.No Solid And Sound Strategy

The first rule of investing is never to lose money.

All companies are systems made to generate money consistently. And like companies, so should we.

Without a sound and solid strategy guaranteed to make money long-term, it is a problem.

The market is like a casino but can have better odds. And without a solid strategy, you will eventually lose. It can be hard to follow a game plan when you see people next to win big. But with a sound strategy you are making money, no matter the hand you were dealt.

Every single investment can always go wrong. And we have to factor that in with our investment decisions.

2.Too Low Time In The Market

Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things just take time: You can't produce a baby in one month by getting nine women pregnant. - Warren Buffet

When you buy, it means you placed a bet that the one who sold is wrong. Or that you have more patience.

With enough time, there is a much higher probability the odds may turn in our favor. If the investment was sound, to begin with.

Stocks are highly volatile. The short-term fluctuations may be much more than the result.

On average, max and lowest price of a stock differs by about 50% in any given year.

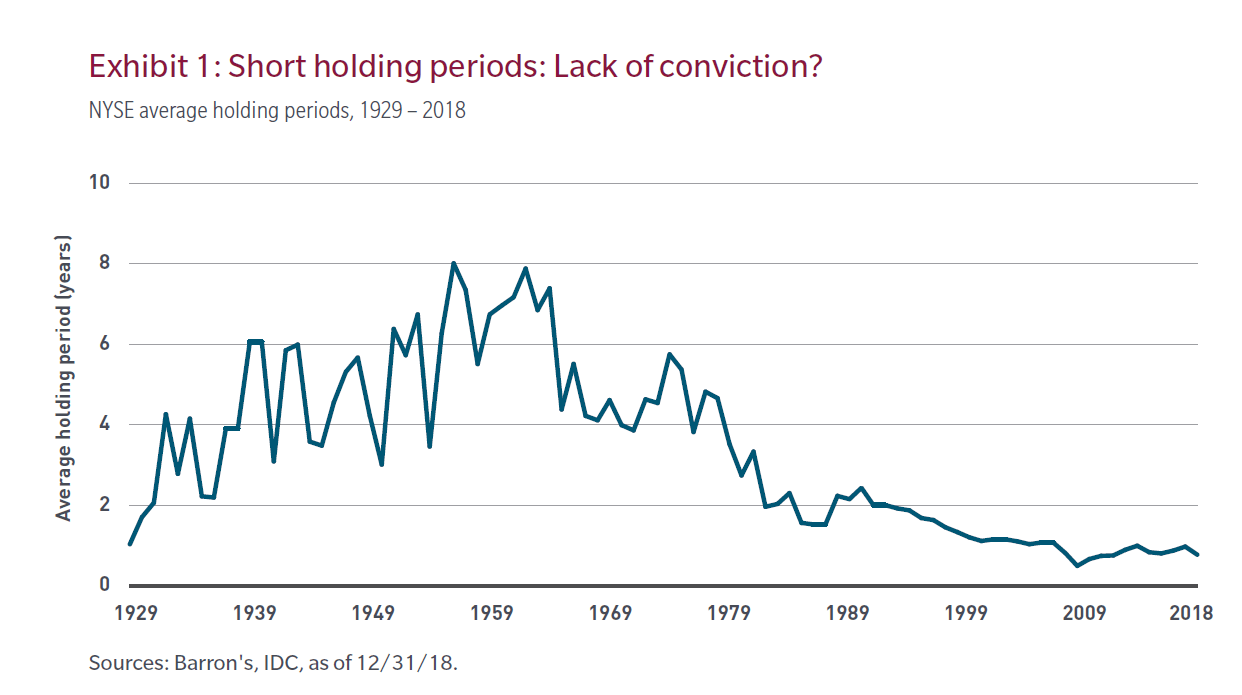

The stock holding time has drastically decreased over the years. It has to do with how simple buying stocks has become. And how easily available news is.

People get scared of any short-term bad news. And seeing losses also scares us and makes us more likely to sell.

3.Not Benchmarking Yourself

When buying any investment, it is crucial to compare ourselves. Even if we end up getting way worse returns compared to the benchmark.

It is far better to know your return is not great on average than to think you are great with below-average results.

Easiest is to compare to an S&P 500 fund. But over a long period.

A risk-free rate is also something that can be good to benchmark. It essentially means an investment that is no risk. Without risk does not exist. So it means a very low-risk investment.

Governments like the U.S has a very extremely low risk of going bankrupt. So a 3-month treasury bond is usually considered a risk-free rate.

You can also benchmark to other investments, but these are the bare essentials. That can get the job done for most people.

Since most people nor professionals ever beat the s&p 500 in 15 years.

4.Don't Know The Intrinsic Value

Buying undervalued stocks is our goal. And you should have some idea when it is starting to get expensive.

And when that time is closing in, it can be time to look for other investments.

Most people sell when it gets down or up and have no idea why. And that is a mistake since it means no basic understanding of the stock.

Before purchasing, you should know when you may sell it. Anything can get too expensive or too cheap.

And your job as an investor is to buy undervalued assets. Since we hope they will appreciate in the future.

Knowing the intrinsic value will also make it less likely to overpay for an investment.

5.Buying/Selling Based on Short-Term Performance

Buying or selling based on short-term fluctuations means letting your emotions be in charge.

If a stock goes up or down in days or weeks, it should not mean it is time for an impulse buy/sell.

It can make a stock much more or less attractive. If you can't wait for at least a few months before a transaction, then your emotions are in charge.

Sure it can end up good sometimes. Investing regularly because of emotions is usually a bad sign.

It is harder said than done. Nonetheless should be in every investor's luggage.

6.Trading Too Much

Trading fees are a cost that can add up and eat away at your returns. It also requires more time since you have to do transactions yourself.

And on average, people are bad at trading stocks.

There are great investors, however, that are part traders. So it can work, but the odds are very slim. Like extremely slim.

For most, it is a bad idea to trade since it adds extra costs, fewer returns, and more work. Most traders lose in most ways.

It can be a thrilling and exciting experience, but I suggest seeking it in ways that won't hurt your wallet as much.

7.Being Married To The Investment

Any relationship solely based on past performance is a bad idea if new things have come to the surface.

For example, if a stock goes up by a ridiculous amount. We should base on the new information that the stock now may be expensive.

When a company grows to a certain point, it will cease to grow as much and eventually even shrink.

People often hype these stocks, since they had massive returns in the past. And by that logic should go as well in the future. And they have grown to like, love, and eventually marry them.

However, don't get me wrong, past performance is all we got to try and predict the future. But it is not a certainty, and these loved companies can often be overvalued.

The greater the growth rate has been in the past, the less likely to continue that growth.

Being married comes at a price.

8.You Don't Know Some Common Market-Related Statistics

The stock market is different territory, and people should know the pros and cons. Before, going into to get the most out of it.

It has its pros and cons, like anything else. And knowing these, you can know what to expect from it.

And by knowing what to expect, we can play better.

All these averages. No guarantees.

On average, there is a bear market every 3.6 years with a decline of -36%. And it lasts 9.6 months.

92% of funds don't beat the S&P 500 on a 15-year average.

Stocks go up 76% of the time.

Related Article: 7 Statistics on Investing You Need to Know

9.Trusting Someone Else

Blinding trusting people who recommend stocks is unwise. Unless they can come up with an analysis based on relevant facts.

I can't tell you how many people have come up to me and pitched stocks without any understandable facts. And that stock then goes to shit.

The dunning-kruger effect is a psychological factor that states that the person who knows the least about a subject is the loudest. And the more experienced people are either, silent since they know how much they don't know.

And the most experienced people can't come up with a straight answer since they know how complicated the subject is.

And if you wanna talk about why you're buying a stock. The goal should be to explain it so easy even a 10-year-old or a golden retriever can understand.

10.Not Thinking In Terms of Statistics

We are often bad at dealing with uncertainties. And that is where statistics come to play.

Since nothing in life is certain we need a way of dealing with it and still making well-informed decisions.

Even if we make well-informed decisions failure is possible. In short, calculate the chance you may be wrong. Or something unexpected and unforeseeable may happen.

Let's imagen the chance of winning at roulette was 90%. The odds are in our favor. But if we go all in every time, we will eventually lose everything.

Investing in the stock market can be in your favor if good strategies are applied. Just like our roulette table.

And we won't know the exact odds but trying to turn them in our favor is a key element of investing.